Did Rmd Tables Change For 2021 . say you have traditional iras worth $100,000 at the end of 2021. find out about required minimum distributions on your retirement plan under internal revenue code sections 401(a)(9), 408(a)(6) and. the irs issued its highly anticipated final regulations for required minimum distributions on july 19, 2024. review the required minimum distribution rules for certain retirement plans, including traditional iras, sep iras, simple iras and. Under the old tables, the distribution factor was 25.6, and so you'd have to take out $100,000. individuals who reached 70 ½ in 2019, (70 th birthday was june 30, 2019 or earlier) did not have an rmd due for 2020,. since the cares act waived all 2020 rmds, to use the life expectancy option, generally you must begin taking distributions. the irs has finalized regulations updating the tables used by retirement plans (including 401(k) plans) to calculate required.

from levelfa.com

since the cares act waived all 2020 rmds, to use the life expectancy option, generally you must begin taking distributions. say you have traditional iras worth $100,000 at the end of 2021. find out about required minimum distributions on your retirement plan under internal revenue code sections 401(a)(9), 408(a)(6) and. the irs has finalized regulations updating the tables used by retirement plans (including 401(k) plans) to calculate required. the irs issued its highly anticipated final regulations for required minimum distributions on july 19, 2024. individuals who reached 70 ½ in 2019, (70 th birthday was june 30, 2019 or earlier) did not have an rmd due for 2020,. review the required minimum distribution rules for certain retirement plans, including traditional iras, sep iras, simple iras and. Under the old tables, the distribution factor was 25.6, and so you'd have to take out $100,000.

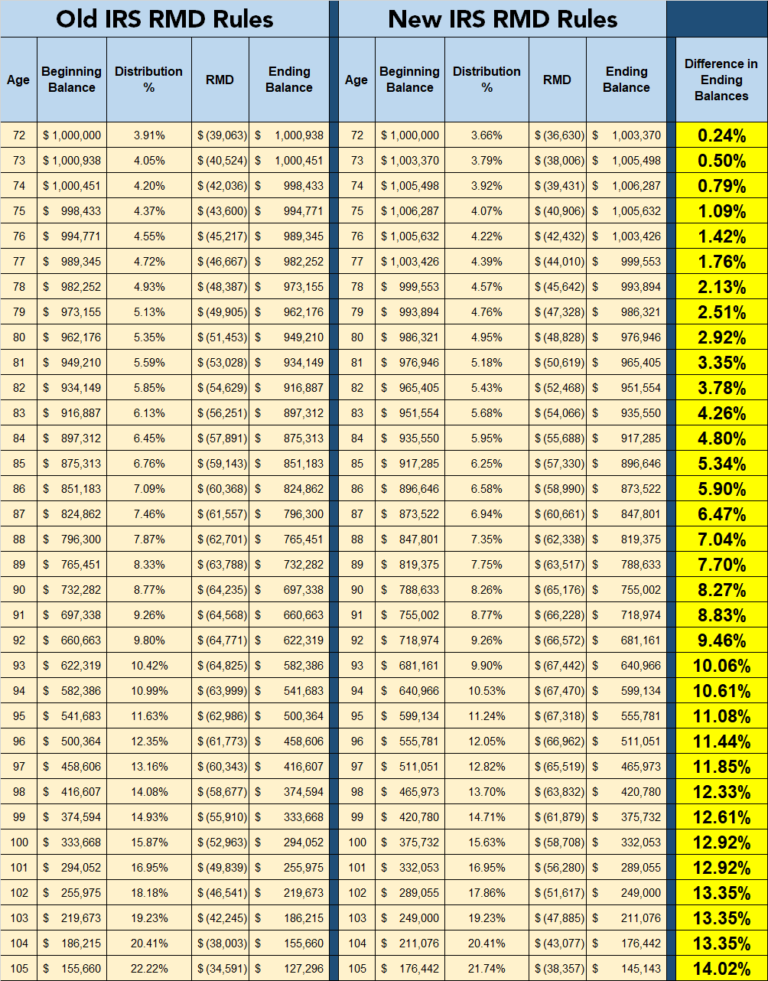

IRS Change Will Decrease RMDs Beginning in 2022 Level Financial Advisors

Did Rmd Tables Change For 2021 individuals who reached 70 ½ in 2019, (70 th birthday was june 30, 2019 or earlier) did not have an rmd due for 2020,. find out about required minimum distributions on your retirement plan under internal revenue code sections 401(a)(9), 408(a)(6) and. since the cares act waived all 2020 rmds, to use the life expectancy option, generally you must begin taking distributions. Under the old tables, the distribution factor was 25.6, and so you'd have to take out $100,000. say you have traditional iras worth $100,000 at the end of 2021. review the required minimum distribution rules for certain retirement plans, including traditional iras, sep iras, simple iras and. individuals who reached 70 ½ in 2019, (70 th birthday was june 30, 2019 or earlier) did not have an rmd due for 2020,. the irs issued its highly anticipated final regulations for required minimum distributions on july 19, 2024. the irs has finalized regulations updating the tables used by retirement plans (including 401(k) plans) to calculate required.

From awesomehome.co

Rmd Tables For Beneficiaries Awesome Home Did Rmd Tables Change For 2021 the irs issued its highly anticipated final regulations for required minimum distributions on july 19, 2024. individuals who reached 70 ½ in 2019, (70 th birthday was june 30, 2019 or earlier) did not have an rmd due for 2020,. since the cares act waived all 2020 rmds, to use the life expectancy option, generally you must. Did Rmd Tables Change For 2021.

From andraazsherrie.pages.dev

Rmd Tables 2024 Calculator Ppt Flora Michell Did Rmd Tables Change For 2021 Under the old tables, the distribution factor was 25.6, and so you'd have to take out $100,000. since the cares act waived all 2020 rmds, to use the life expectancy option, generally you must begin taking distributions. say you have traditional iras worth $100,000 at the end of 2021. individuals who reached 70 ½ in 2019, (70. Did Rmd Tables Change For 2021.

From printablegorinoyu.z21.web.core.windows.net

Irs Rmd Factor Tables 2023 Did Rmd Tables Change For 2021 since the cares act waived all 2020 rmds, to use the life expectancy option, generally you must begin taking distributions. Under the old tables, the distribution factor was 25.6, and so you'd have to take out $100,000. individuals who reached 70 ½ in 2019, (70 th birthday was june 30, 2019 or earlier) did not have an rmd. Did Rmd Tables Change For 2021.

From printabledenonivv.z4.web.core.windows.net

Life Expectancy Factor For Rmd 2023 Did Rmd Tables Change For 2021 individuals who reached 70 ½ in 2019, (70 th birthday was june 30, 2019 or earlier) did not have an rmd due for 2020,. the irs has finalized regulations updating the tables used by retirement plans (including 401(k) plans) to calculate required. Under the old tables, the distribution factor was 25.6, and so you'd have to take out. Did Rmd Tables Change For 2021.

From www.mrbaccounting.com

RMDs (Required Minimum Distributions) Top Ten Questions Answered MRB ACCOUNTING 516.427.7313 Did Rmd Tables Change For 2021 the irs issued its highly anticipated final regulations for required minimum distributions on july 19, 2024. since the cares act waived all 2020 rmds, to use the life expectancy option, generally you must begin taking distributions. Under the old tables, the distribution factor was 25.6, and so you'd have to take out $100,000. the irs has finalized. Did Rmd Tables Change For 2021.

From printablealmafullertondw.z4.web.core.windows.net

Irs Rmd Factor Tables 2023 Did Rmd Tables Change For 2021 find out about required minimum distributions on your retirement plan under internal revenue code sections 401(a)(9), 408(a)(6) and. the irs issued its highly anticipated final regulations for required minimum distributions on july 19, 2024. Under the old tables, the distribution factor was 25.6, and so you'd have to take out $100,000. review the required minimum distribution rules. Did Rmd Tables Change For 2021.

From levelfa.com

IRS Change Will Decrease RMDs Beginning in 2022 Level Financial Advisors Did Rmd Tables Change For 2021 since the cares act waived all 2020 rmds, to use the life expectancy option, generally you must begin taking distributions. say you have traditional iras worth $100,000 at the end of 2021. the irs issued its highly anticipated final regulations for required minimum distributions on july 19, 2024. the irs has finalized regulations updating the tables. Did Rmd Tables Change For 2021.

From printablealmafullertondw.z4.web.core.windows.net

Irs Rmd Factor Tables 2023 Did Rmd Tables Change For 2021 the irs issued its highly anticipated final regulations for required minimum distributions on july 19, 2024. review the required minimum distribution rules for certain retirement plans, including traditional iras, sep iras, simple iras and. find out about required minimum distributions on your retirement plan under internal revenue code sections 401(a)(9), 408(a)(6) and. individuals who reached 70. Did Rmd Tables Change For 2021.

From www.pinterest.com

IRS Proposes New RMD Life Expectancy Tables To Begin In 2021 Periodic table, Nerd, Life expectancy Did Rmd Tables Change For 2021 the irs issued its highly anticipated final regulations for required minimum distributions on july 19, 2024. review the required minimum distribution rules for certain retirement plans, including traditional iras, sep iras, simple iras and. since the cares act waived all 2020 rmds, to use the life expectancy option, generally you must begin taking distributions. say you. Did Rmd Tables Change For 2021.

From www.nj.com

What is a required minimum distribution (RMD)? Did Rmd Tables Change For 2021 individuals who reached 70 ½ in 2019, (70 th birthday was june 30, 2019 or earlier) did not have an rmd due for 2020,. since the cares act waived all 2020 rmds, to use the life expectancy option, generally you must begin taking distributions. the irs has finalized regulations updating the tables used by retirement plans (including. Did Rmd Tables Change For 2021.

From billqelinore.pages.dev

Did Rmd Rules Change For 2024 Dalia Eleanor Did Rmd Tables Change For 2021 the irs issued its highly anticipated final regulations for required minimum distributions on july 19, 2024. Under the old tables, the distribution factor was 25.6, and so you'd have to take out $100,000. individuals who reached 70 ½ in 2019, (70 th birthday was june 30, 2019 or earlier) did not have an rmd due for 2020,. . Did Rmd Tables Change For 2021.

From www.hotzxgirl.com

Life Expectancy Chart For Rmd For 2022 Hot Sex Picture Did Rmd Tables Change For 2021 Under the old tables, the distribution factor was 25.6, and so you'd have to take out $100,000. since the cares act waived all 2020 rmds, to use the life expectancy option, generally you must begin taking distributions. the irs issued its highly anticipated final regulations for required minimum distributions on july 19, 2024. the irs has finalized. Did Rmd Tables Change For 2021.

From bernardinawkaryl.pages.dev

Did Rmd Rules Change For 2024 Ketty Merilee Did Rmd Tables Change For 2021 since the cares act waived all 2020 rmds, to use the life expectancy option, generally you must begin taking distributions. say you have traditional iras worth $100,000 at the end of 2021. review the required minimum distribution rules for certain retirement plans, including traditional iras, sep iras, simple iras and. the irs issued its highly anticipated. Did Rmd Tables Change For 2021.

From aewealthmanagement.com

AE Wealth Management Minimum Retirement Payouts Blog AE Wealth Management Did Rmd Tables Change For 2021 the irs has finalized regulations updating the tables used by retirement plans (including 401(k) plans) to calculate required. the irs issued its highly anticipated final regulations for required minimum distributions on july 19, 2024. individuals who reached 70 ½ in 2019, (70 th birthday was june 30, 2019 or earlier) did not have an rmd due for. Did Rmd Tables Change For 2021.

From www.retireguide.com

RMD Table, Rules & Requirements by Account Type Did Rmd Tables Change For 2021 individuals who reached 70 ½ in 2019, (70 th birthday was june 30, 2019 or earlier) did not have an rmd due for 2020,. Under the old tables, the distribution factor was 25.6, and so you'd have to take out $100,000. find out about required minimum distributions on your retirement plan under internal revenue code sections 401(a)(9), 408(a)(6). Did Rmd Tables Change For 2021.

From 2022bty.blogspot.com

New Uniform Lifetime Table 2022 2022 BTY Did Rmd Tables Change For 2021 the irs has finalized regulations updating the tables used by retirement plans (including 401(k) plans) to calculate required. review the required minimum distribution rules for certain retirement plans, including traditional iras, sep iras, simple iras and. find out about required minimum distributions on your retirement plan under internal revenue code sections 401(a)(9), 408(a)(6) and. since the. Did Rmd Tables Change For 2021.

From www.artsz.org

How To Calculate Rmd For 2022 artsz Did Rmd Tables Change For 2021 the irs issued its highly anticipated final regulations for required minimum distributions on july 19, 2024. the irs has finalized regulations updating the tables used by retirement plans (including 401(k) plans) to calculate required. find out about required minimum distributions on your retirement plan under internal revenue code sections 401(a)(9), 408(a)(6) and. individuals who reached 70. Did Rmd Tables Change For 2021.

From rioalbumzz.blogspot.com

Rmd Table 2021 / What Do The New IRS Life Expectancy Tables Mean To You Run the numbers Did Rmd Tables Change For 2021 since the cares act waived all 2020 rmds, to use the life expectancy option, generally you must begin taking distributions. individuals who reached 70 ½ in 2019, (70 th birthday was june 30, 2019 or earlier) did not have an rmd due for 2020,. find out about required minimum distributions on your retirement plan under internal revenue. Did Rmd Tables Change For 2021.